Pharma M&A is Too Expensive: Now What?

M&A has become an increasingly expensive method of securing new assets, capabilities and growth for pharmaceutical companies. This has been a natural consequence of the combination of an abundance of cheap capital with the relentless ticking clock of patent expiries. Cheap capital puts pressure on large firms to “do something”, and in most cases acquiring […]

Integrated and Open Innovation: The Best of Both Worlds

Pharmaceutical companies continue to embrace the concept of leveraging innovation from external sources to build and balance their internal R&D pipelines. However, management systems that are geared towards progressing internal assets struggle to cope with the challenge of dealing with outside parties. This means that open innovation is often assigned to a new group of […]

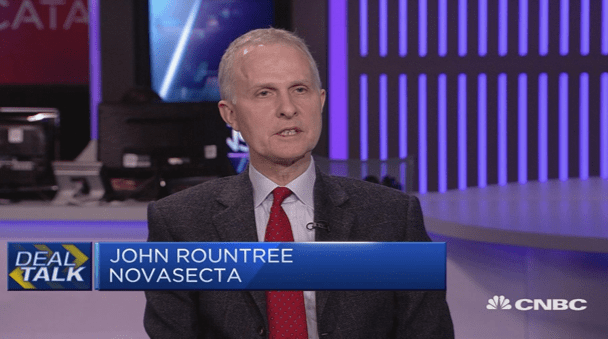

Continued innovation pays for Big Pharma (CNBC)

In light of the announcement of Novartis’ and Pfizer’s Q4 results, John Rountree, was invited on CNBC to discuss innovation in the pharmaceuticals market. John highlights the continued strategic drive towards traditional innovation, which helps companies avoid the dangers of being a “one product company” and allows them to protect themselves from the risks of […]

Commercial and R&D: Value Lost in Translation?

Aligning R&D activities with commercial realities is an issue as old as the pharmaceutical industry itself. But it’s no closer to being solved. The importance of a commercial perspective in R&D is only growing as the downward pressure on drug prices and limitations on market access from payers continue to increase. In parallel, as pharmaceutical […]