The realities of unrelenting price pressure and patent expiries put a special pressure on pharmaceutical companies to consistently create new and differentiated medicines. Pharma companies are compelled to innovate in order to survive, and the rewards for successful innovation are substantial. To understand the magic of innovation in pharma today, we have explored the lessons that can be learned from the FDA’s breakthrough innovation scheme. This relatively recent scheme provides a good indication of compounds that have the potential to become game changers, and through that the habits and behaviours of the companies that are achieving this, for some the “ultimate” level of innovation. So in this paper we review and analyse the granted breakthrough approvals from the scheme’s initiation in 2012 until the end of 2016, and explore the companies that are leading the way in the scheme. We conclude by exploring the lessons learned for would-be breakthrough innovators, defining the criteria and parameters that enable the discovery and development of game changing drugs.

A new measure of innovation for the pharmaceutical industry

The FDA’s introduction of its breakthrough designation scheme in July 2012 provided a new standard and benchmark for innovation in the pharmaceutical industry. The scheme aims to fast track and expedite the development and review of drugs for serious or life-threatening conditions. More specifically the criteria for breakthrough therapy designation require preliminary clinical evidence that demonstrates the drug may have substantial improvement on at least one clinically significant endpoint versus existing therapy. Once a drug has been designated as a breakthrough therapy, the FDA will then work with the sponsor (applicant) to ensure the design of the clinical trials is efficient and practical. Regulatory standards to demonstrate safety and efficacy must still be met to support final marketing approval. Nearly five years in, the scheme therefore now provides a comparative framework between the different products in development stage and a consistent indication of products’ potential of becoming game changers.

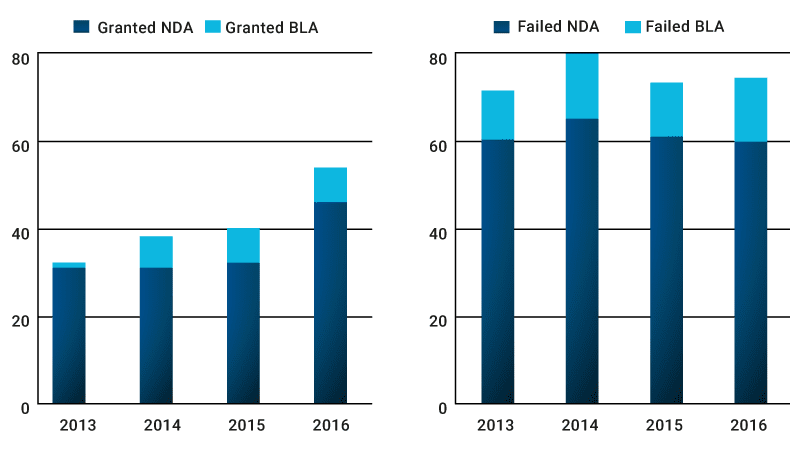

Between 2013 and 2016, the FDA’s CDER (Centre of Drug Evaluation and Research) and CBER (Centre of Biologics Evaluation and Research) have received 387 small molecules and 81 biologics breakthrough designation requests respectively. Of these requests, 36% have been granted by the CDER and 30% by the CBER. There has been a consistent year on year increase of granted breakthrough designations, coupled with a slow decline of failed requests that are either denied or withdrawn by the applicant.

As the Breakthrough Designation scheme is maturing, more designations are being granted and fewer are failing for both small molecules (NDA) and biologics (BLA)

Source: Novasecta analysis of the FDA’s Breakthrough Designations List. NDA is New Drug Application through CDER, BLA is Biologic Licence Application through CBER. Failed = Denied + Withdrawn

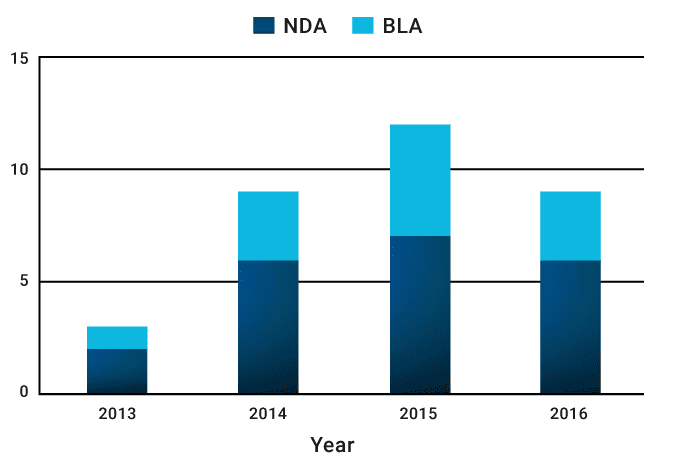

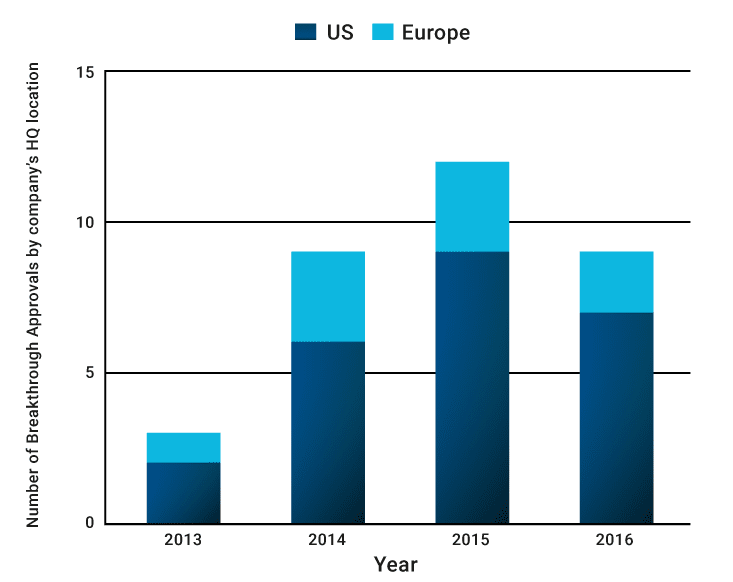

While the number of granted designations has been increasing, it is also encouraging to note that in the last three years an average of 10 breakthrough approvals per year have also been granted. For an industry with research and development timelines that can stretch to 12 years, this represents an important achievement for the companies that have made it happen.

FDA granted an average of 10 breakthrough marketing approvals per year from 2014 – 2016

Source: Novasecta analysis of the FDA Breakthrough Approvals List (2013 – 2016)

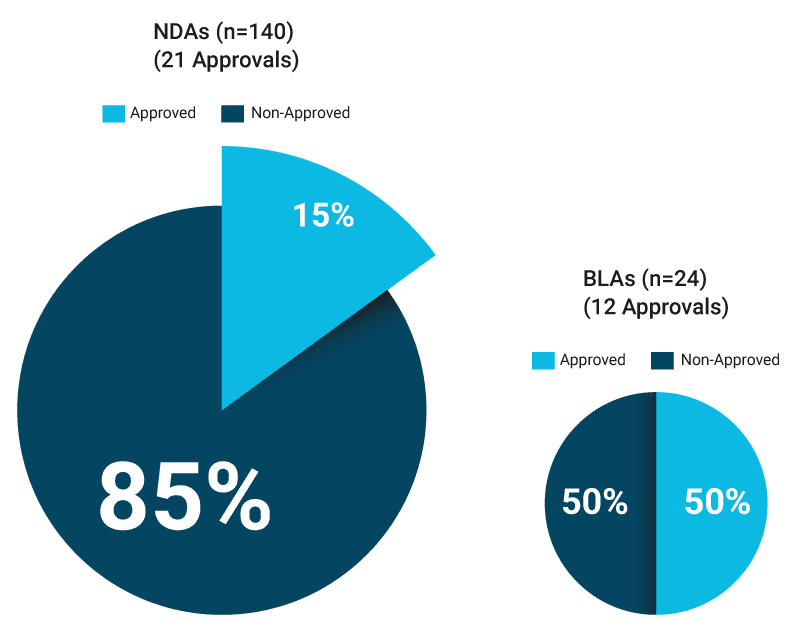

While the number of granted small molecule (NDA) breakthrough designations is almost six times the number of granted biologics (BLA) designations, the story for breakthrough designations that have subsequently been translated into marketing approvals is very different: the percentage of granted designations that subsequently obtained full marketing approvals is 50% for BLAs and only 15% for NDAs.

The chance of securing a marketing approval after a breakthrough designation is significantly higher for biologics than for small molecules

Source: Novasecta analysis of the FDA Breakthrough Approvals List (2013 – 2016)

In summary, the year on year increase of granted breakthrough designations will with time surely translate into a higher number of breakthrough approvals. The fact that biologics are delivering a higher ratio of approvals compared with small molecules points to a more biologics-oriented innovation landscape for the future.

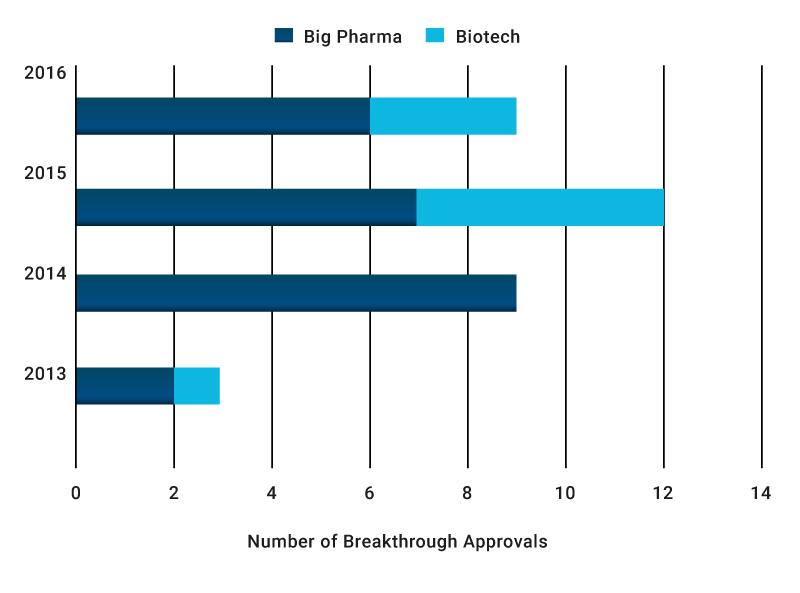

So far breakthrough innovation is a Big Pharma – Biotech phenomenon

Now we take a closer look at the companies that are taking the lead in breakthrough innovation in the pharmaceutical industry. We considered both size (using revenue as a measure) and geographical presence of these companies, for both designations and approvals, also noting the originators of the innovation. In terms of the breakthrough designation applicants that subsequently achieved marketing approvals, 73% were big pharmas/biopharmas (defined as revenue greater than $10bn) and 27% were biotechs (defined as revenue up to $3bn). Note we are using the term “biotech” to mean smaller and earlier stage companies rather than the nature of the molecule (biologics or small). So far companies with revenues between $3bn and $10bn have been notably absent from the breakthrough approvals list.

73% of breakthrough approvals have been achieved by Big Pharma applicants (n=33)

Source: Novasecta Analysis of the FDA Breakthrough Approvals List (2013-2016) and GlobalData for companies’ revenues

Though it is still in its early days for the scheme, it is interesting to note that in last two years smaller biotech companies have started to take an important share of approvals in comparison to Big Pharmas, taking their drugs all the way from discovery to regulatory approval.

From a geographic perspective, breakthrough approvals have been an exclusively US and European domain, with 73% of the total granted breakthrough approvals from 2013 to 2016 being to companies located in the US, and 27% to those located in Europe. Many reasons may explain these regional disparities, including the fact that it is the US’s FDA that has the scheme. US companies also have better access to funds for high-risk innovation, are close to thriving scientific hubs with access to exceptional talent, and a long tradition of entrepreneurship.

So far US companies have led the way in achieving breakthrough approvals (n=33)

Source: Novasecta Analysis of the FDA Breakthrough Approvals List and Companies’ websites

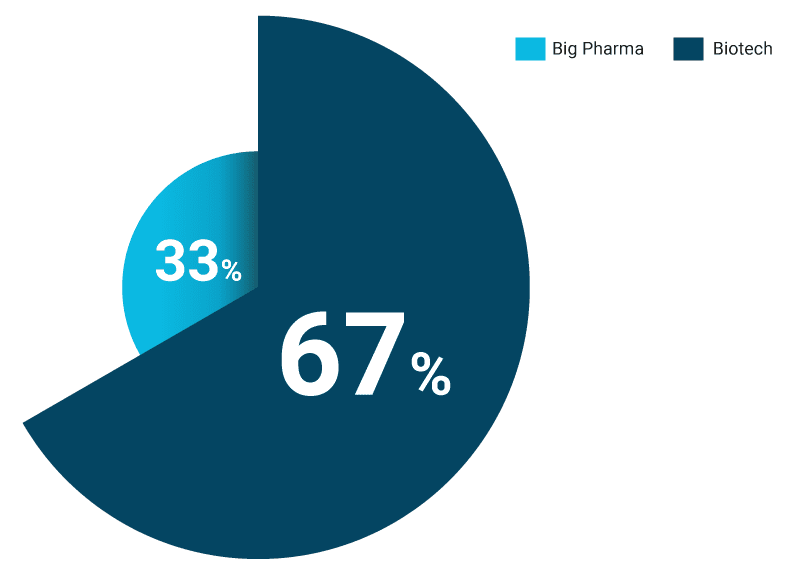

By contrast with the granted approvals being so far dominated by Big Pharmas, when considering the originators of the breakthrough approvals (the companies that created the initial compound before it was acquired or partnered for further research and development), the majority are biotechs, comprising 67%, with only 33% coming from the internal R&D of Big Pharma. It therefore appears that many Big Pharmas have been acquiring or partnering with small biotech innovators prior to requesting a breakthrough designation that they hope will subsequently result in an approval.

67% of the companies that originated the drugs that then achieved breakthrough approvals are Biotechs (n=33)

Source: Novasecta analysis of FDA Breakthrough Approvals and GlobalData for companies’ revenue

Of the Big Pharma companies that have led the way in originating the 11 breakthrough drugs that have subsequently been approved, Roche comes first with three approvals, all from its wholly owned subsidiary Genentech, followed by MSD, Boehringer Ingelheim, and Gilead with two approvals each, and Novartis and AstraZeneca with one approval each. It is also worth noting the US vs. Europe origination phenomenon for Big Pharmas. The European-headquartered Big Pharmas have originated eight breakthrough drugs internally compared to four for their US-headquartered counterparts. This also corresponds to the trend we observed in previous research of US Big Pharma companies being involved in more M&A and partnership activities than their European counterparts.

By contrast with those that originated the breakthrough molecules, of the sponsors that applied for breakthrough designations that subsequently achieved approvals, Gilead, Genentech and Abbvie have taken the lead, with four, four and three respective approvals obtained between 2013 and 2016. In the case of Gilead and Genentech this represents an impressive rate of one breakthrough approval per year.

In summary, the typical breakthrough innovator profile so far appears to be companies based in the US or Europe that are very entrepreneurial and have access to funds either through their own financing as a Big Pharma or through external investments as a smaller biotech.

The lessons for Pharma R&D

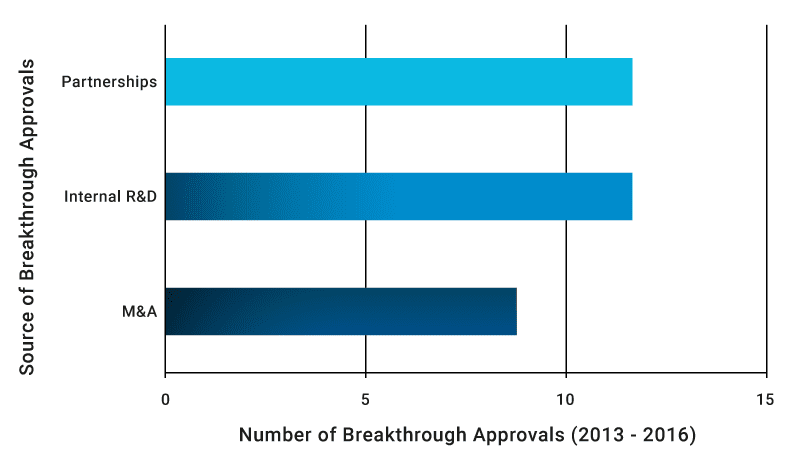

The good news is that companies do not necessarily need to undertake expensive M&A activities to increase their innovation output. Indeed, only 27% of breakthrough-approved drugs between 2013 and 2016 came from M&A, while 73% came from internal R&D and partnerships. As far as breakthrough innovation is concerned, M&A represents a quick fix and not a strategy for the long term. This is even more relevant in an environment where M&A prices are reaching new highs.

Partnerships and strong internal R&D are more sustainable paths to innovation than M&A

Source: Novasecta analysis of FDA Breakthrough Approvals and press releases

Our analysis of the breakthrough approvals confirms our prior research (M&A versus Partnerships, Defragmenting R&D) that strong internal R&D and partnerships represent the best way to innovate in today’s pharmaceutical environment. 73% of breakthrough approvals so far were achieved through this path. Developing internal know-how and capabilities is a sound strategy to build the foundations that will enable continuous excellent innovation. This can be achieved by:

- Focusing on the company’s strength and capabilities

- Collaborating strategically with other pharmaceutical companies, exchanging capabilities and assets that can create increased value for both parties involved

- Fostering an entrepreneurial spirit and biotech mentality internally, with self-directed and motivated entities that entrepreneurially secure funding by understanding the commercial and business rationale for their innovation.